May 21, 2019

IN THIS ISSUE

COMBINE SIMPLE PATTERNS FOR MORE RELIABLE MODELS

NEW TRADESTATION DATAFEED

_________________________________________________________________________________________________________

COMBINE SIMPLE PATTERNS FOR RELIABLE MODELS

By Marge Sherald, President

_________________________________________________________________________________________________________

There’s an interesting interview in the May 2019 issue of Technical Analysis of STOCKS & COMMODITIES magazine about building models that separate signal from noise. Editor Jayanthi Gopalakrishnan spoke with David Pieper from Germany about his model building practices. I believe many of our NeuroShell Trader users will find the article a worthwhile read.

“I want to find a consistent, measurable, and predictive pattern. I don’t want to trade on

Noise because noise won’t bring me any money.” —- David Pieper

Pieper relates his experience that model building takes effort and persistence and it has to match your trading style.

Some of the key points in the article reflect what we often tell our customers:

1. Limit the number of inputs to a model to prevent overfitting on training data.

2. Be realistic – there is no one perfect model for everything. You can do well trading models that are 60 to 70% correct.

3. You need different trading systems for different market conditions and securities.

4. It’s good to have several models for the same market condition such as a trending market.

As a practical exercise, I incorporated those points into a model that combines three different neural net predictions into a single Trading Strategy. This model enters the market when two out of the three predictions agree. Click here for details on how combining models makes them more reliable.

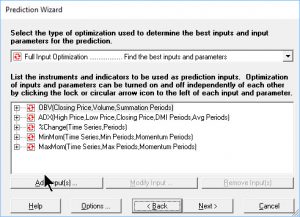

When you examine the chart, which you can download here, you’ll note that each prediction includes five or less inputs.

The wizard lists the inputs to the first prediction on the chart.

The combined model is more profitable in both the optimization period and the out-of-sample trading period as noted by the solid green equity curve.

The chart combines three neural net predictions into a single Trading Strategy.

“My strategies are very simple. I think the strength is in combining different approaches. I think this is a better way than looking for one single holy grail that doesn’t exist.” —- David Pieper

______________________________________________________________________________________________________

New TradeStation Datafeed

______________________________________________________________________________________________________

Customers have been reporting problems when using the TradeStation Datafeed and Brokerage Server program so we have adjusted the code to better handle the way TradeStation sends data from their server. We believe the new code will allow you to obtain data farther back in time for intraday data.

You can download the new software from www.ward.net in the Downloads, Release News and Upgrade Information, TradeStation Datafeed and Brokerage section.

No changes were made to the brokerage portion of the software.