What do you do when current market conditions don’t allow you to simply retrain a formerly profitable trading model?

The solution is to think outside the box. Think changing securities, instrument category, timeframes, modeling technique (trading rules, neural nets, genetic algorithms), etc.

In our March 25, 2015, newsletter we developed a ChaosHunter model for the AUD/CAD Forex pair. We originally chose that pair because the Canadian and Australian economies are based on natural resources. However the formula from the original model was no longer profitable. So we exported current data from a NeuroShell Trader chart and began to craft a new ChaosHunter model. We selected the training data so it included some up, down, and sideways periods in the same price range.

We Used a ChaosHunter Model Template

After loading the data in ChaosHunter, we loaded the Steve Ward model template for intraday models. Steve Ward developed ChaosHunter and tested thousands of trading models. The template is based on his initial settings.

To access the template, open the ChaosHunter File menu and select Load Template.

Note that the template does not select any inputs on the Inputs tab but does select the Open as the output. The inputs are created by applying technical indicators to price data on the Formula tab.

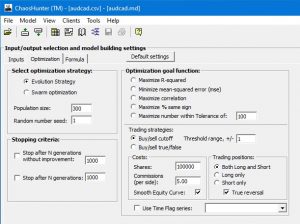

On the Optimization tab, the template changes the default population size to 300.

We modified some of the generic template settings to make them suitable for trading Forex.

Forex Settings

Number of shares = 100,000 to match a standard Forex trade and set commissions to $5 each side.

Set trading threshold range to 1 to match narrow range of Forex trades

The training objective was set to Smooth Equity Curve and trading positions were set to True Reversal.

Formula Tab

Removed option to include ChaosInput to simplify the model.

Removed similar technical indicators included in template.

Removed Neural operations to create a model that can be used in multiple platforms.

After several unsuccessful attempts to work with 1 hour bars as we did in the original March 2015 article, we changed the timeframe from 1 hour to 5 minute bars and then 10 minute bars. Many Forex models are based on either 5 or 10 minute bars, so we tried to work in those timeframes.

When that didn’t work, we switched to 7 minute bars to “learn” from the 5 minute traders and get in before the 10 minute traders. We used the same settings described previously for the 5, 7, and 10 minute bar tests.

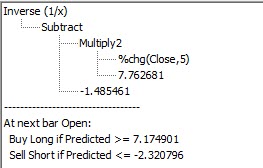

ChaosHunter Formula

With the 7 minute bars ChaosHunter found a simple formula for the problem that produced trading signals on peaks and valleys in the training data.

The resulting model also did well on the 2056 bars of out-of-sample data.

Add ChaosHunter to NeuroShell Trader for Live Trading

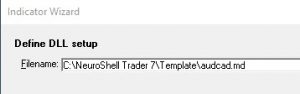

In order to prepare the ChaosHunter model for live trading, we copied the audcad.md file from the original directory to the c:\NeuroShell Trader 7\template directory.

Next we called the model as an indicator in the Trader by choosing the External Program and Library Calls category and selecting the “ChaosHunter trading signal” indicator. The indicators Define DLL setup screen is displayed above and we selected the audcad.md file in the Trader 7\template directory.

To construct trading rules in the Trader we used the Relational indicator A = B. A corresponds to the value of the ChaosHunter trading signal indicator and B is set to 1 for Long Entries and -1 for Short Entries.

The Long Entry rule is pictured below. We repeated the process for the Short Entry and set B to -1. Long and Short Exit conditions are not needed because the ChaosHunter model was developed as a reversal system.

The date ranges, units traded, and commissions matched those used in ChaosHunter. In NeuroShell Trader we set the Trading Strategy to trade in round lots of 1000 units.

Setting the Exchange Rate

Since the AUD/CAD model is not traded in US currency, we set the exchange rate to AUD/USD on the Trader’s cost tab in the Trading Strategy wizard. USD is the quote currency in this example.

The system equity shown at the bottom of the chart is stated in US dollars.

https://Nstsupport.wardsystemsgroup.com/support/files/Oct20newsletter.zip to download a copy of the NeuroShell Trader and the corresponding ChaosHunter files.

To learn more about using templates in ChaosHunter, search for “template” in the ChaosHunter help file.