Please note that the text for this tip in the print version is incorrect. The corrected version is below

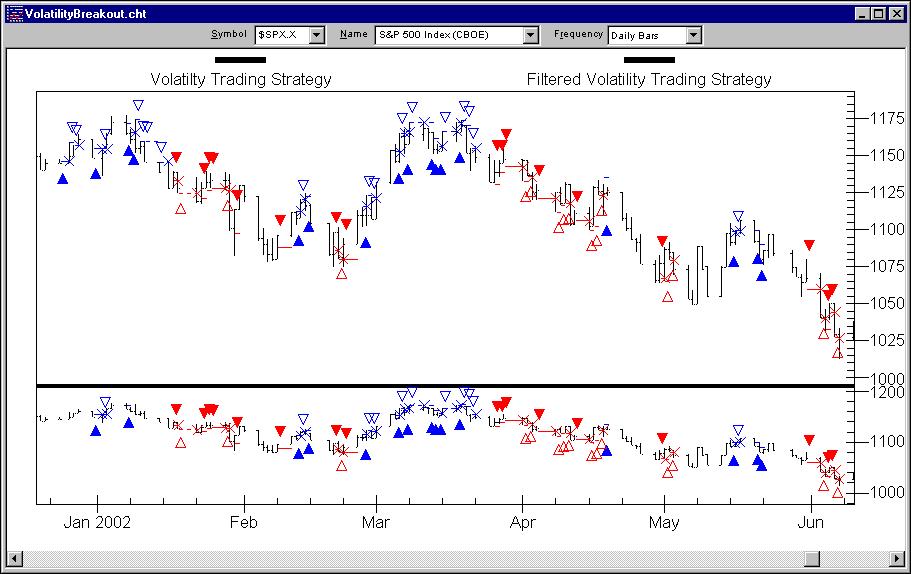

To implement Pezzutti’s Volatilty Breakout trading system in the NeuroShell Trader, select ‘New Trading Strategy …’ from the ‘Insert’ menu and enter the following long and short entry conditions in the appropriate locations of the Trading Strategy Wizard:

Generate a buy long STOP order if ALL of the following are true:

A>B ( Close, MovAvg ( Close, 13 ) )

A<B ( Close, Lag ( Close, 1 ) )

Using a Long Entry Stop Price of:

Add2( Close, Multiply2 ( 0.5, Subtract ( High, Low ) ) )

Generate a sell long LIMIT order if ALL of the following are true:

A=B(Close,Close)

Using a Long Exit Limit Price of:

High

Generate a sell short STOP order if ALL of the following are true:

A<B ( Close, MovAvg ( Close, 13 ) )

A>B ( Close, Lag ( Close, 1 ) )

Using a Short Entry Stop Price of:

Sub( Close, Multiply2 ( 0.5, Subtract ( High, Low ) ) )

Generate a cover short LIMIT order if ALL of the following are true:

A=B(Close,Close)

Using a Short Exit Limit Price of:

Low

If you wish to implement the additional ADX & ATR filters described in the article, simply add the following conditions to the Trading Strategy:

Long Entry additional conditions:

A>B ( AvgDirectionalMovement(High,Low,Close,14,14) , 18 )

A>B ( Divide(Average True Range(High,Low,Close,13), MovAvg(Close,13) , 0.01 )

Short Entry additional conditions:

A<B ( AvgDirectionalMovement(High,Low,Close,14,14) , 82 )

A>B ( Divide(Average True Range(High,Low,Close,13), MovAvg(Close,13) , 0.01 )

If you have the NeuroShell Trader Professional, you can also choose whether or not the system parameters should be optimized. After backtesting the trading strategy, use the ‘Detailed Analysis …’ button to view the backtest and trade by trade statistics for the trading system.

File Download