December 12, 2019

IN THIS ISSUE

Three Methods to Increase Correct Signals

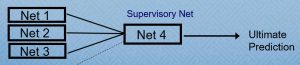

For more advanced users, the NeuroShell Trader can easily implement “ensemble estimators”, wherein several predictions or estimations are fed into a higher level prediction or estimator for the final answer. In this way, the higher level estimator acts like a supervisor who queries his/her employees for their projections before producing his/her own.

We have published a mathematical proof that ensemble systems based on several successful systems are more likely to produce correct trading signals. Click here for the details.

Method 1: Averaging Ensemble Net

Build three predictions, all based upon different inputs. Use the Average 3 indicator from the Arithmetic category to average the three results and produce the final trading signal.

For example, the Long Entry rule could be:

Average 3 of the prediction (or prediction signal) > value set by user

Method 2: Supervisory Ensemble System

Build three predictions, all based upon different inputs.

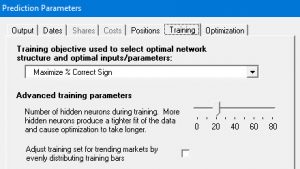

Change Training Objective

The output for Nets 1, 2, and 3 is the %change in open 3 days into the future.

However, on the Training tab, we set the training objective to Maximize % Same Sign. By choosing this objective and setting the Positions tab to “No trading positions”, the net will not produce trading signals, but it will output the expected percent change in open. (See subgraphs 1, 2, and 3 on the chart below.

The Fourth Net Determines When to Trade

The outputs of the three nets are fed into a fourth net which produces the final trading signal. The fourth net has an optimization objective of “Maximize Return on Account Times Equity Curve Correlation”. The Positions tab was set to “Both Long and Short” and “Find Optimal Trading Rules”. The output is “%change in open 3 days into the future” to match Nets 1, 2, and 3.

https://nstsupport.wardsystemsgroup.com/support/files/Dec19newsletter.zip to download the example chart for this method.

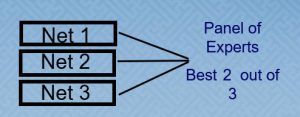

Method 3: Consensus Ensemble Trading Strategy

Build three neural nets and/or trading rules and insert them as Long Entry conditions in the Trading Strategy wizard.

For example, you could use the following:

A>B(Prediction signal 1, 0)

A>B (Close, BB High (Close, 20, 2))

RSI (Close, 5) < 30

At the top of the Long Entry tab, set it to “Generate a Buy Long market order if 2 of the following are true. ”

Make similar rules for the Long Exit tab. For Short Entries, you may want specify that all conditions be true.

To examine how different neural net predictions and a trading rule may be combined into a single trading system, look at Example 19 – E-Minis Combined Nets Hybrid that is also saved in the c:\NeuroShell Trader 7\charts directory.