A price target is an exit which gets you out of a position with a prespecified profit. A price target exit can be created in the NeuroShell Trader in one of two ways:

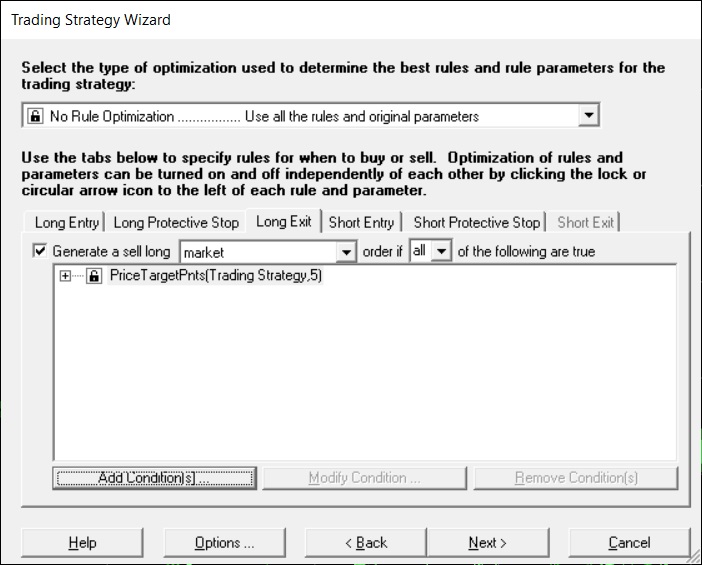

1) Use one of the built in Price Target indicators as your exit condition in conjunction with a market order. This method will get you out at the open of the next bar once the CLOSING price reaches your price target.

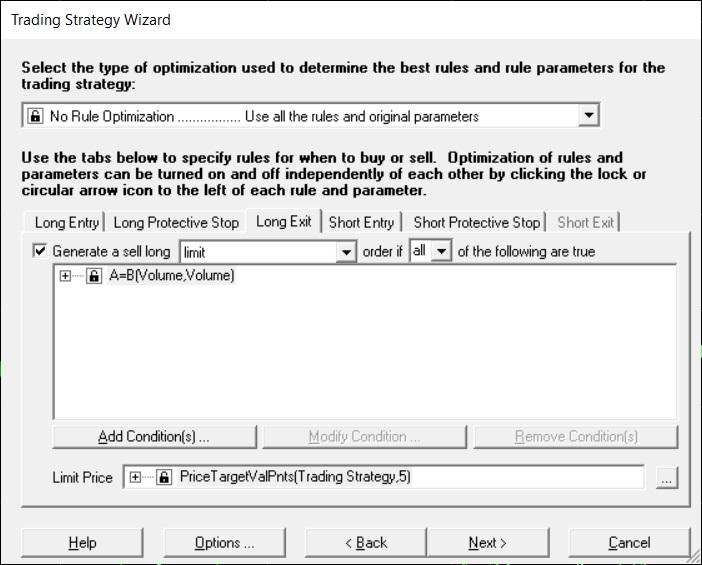

2) Use an exit condition that is always true [for example A=B(Volume,Volume)] in conjunction with a limit order at a price of Add2(EntryPrice(Trading Strategy,0), X) where X is your price target. This method will get you out if future price movement (LOW or HIGH) reaches your price target. Note that for a short exit, the price target should be below the entry price and therefore you should use the Subtract indicator instead of the Add2 indicator.

The difference between #1 and #2 is that #1 reacts to past information using a market order, whereas #2 places a limit order to exit on future price movement before the price movement occurs.

Why you might ask, don’t the Price Target indicators take into consideration the high and low prices? The Trader does not evaluate indicators while a price bar is happening (i.e. tick by tick). It only evaluates indicators when a price bar is complete and all the price bar’s data has been collected (Open, High, Low, Close and Volume). Because of this, the Price Target indicator only evaluates at the end of each price bar and bases its logic on the Closing price. It does not base its logic on High or Low because these prices are past history and realistically you can only now get out at the closing price (actually the open of the next bar, but that information is not yet available when the price target indicators evaluate). Therefore to actually be able to get our near your price target at the end of a full bar, the closing price is looked at instead of the high or low price.