May 12, 2020

IN THIS ISSUE

Find when to trade – THEN build the rules

Last month we introduced the InterChart Tools TradeGate Add-on which allows you to find the level of volatility when your algorithm will deliver its best performance.

What If You Don’t have an Algorithm?

We did some testing in NeuroShell Trader and found that the optimizer can use the TradeGate Add-on by itself to discover the best times to trade. You can then combine the trading times with either a model built in NeuroShell Trader or ChaosHunter to create a successful trading system.

As an example, we’re going to build a system in ChaosHunter to show you how to align the Block Trades indicator with the Time Flag feature in ChaosHunter.

Step 1: Create a Trading System with Only Block Trades Indicators

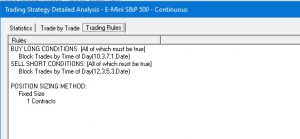

Below are the Trader’s final trading rules for a system based solely on Block Trades indicators.

According to the optimized rules, the Buy Long Conditions blocks trades between 10:45 am until 6:00 pm. The Sell Short Conditions blocks trades from 12:45 pm until 6:30 pm. We want to merge the times to block trades between 10:45 am to 6:30 pm.

Step 2: Convert Times to a Time Flag

We had to convert the times found by BlockTrades to a Time Flag for ChaosHunter. The Time Flag determines when to block or allow trading. ChaosHunter reads the Time Flag as 0 for no trades and any other non-zero value for trades.

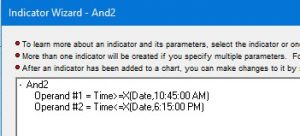

The Trader’s Boolean And 2 indicator merges the times found by the Block Trades indicators.

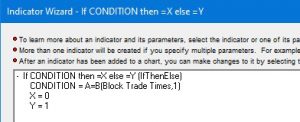

Next we used the Trader’s If/Then/Else rule to output the 0 and 1 values that will be read as a Time Flag in ChaosHunter.

Next we used the Trader’s If/Then/Else rule to output the 0 and 1 values that will be read as a Time Flag in ChaosHunter.

We renamed the rule indicator as TimeFlag and exported that column and price data from the Trader chart as a text file (Trader Tools Menu, Export Chart Data).

Step 3: Load Data File in ChaosHunter and Add Template

We loaded the data file in ChaosHunter, and then selected the Steve Ward Trading Models Intraday template from the File menu, Load Template option.

This template of ChaosHunter settings is the result of building thousands of trading models and is a good starting point for any trading model. (There is a separate template for daily models.)

The template makes use of the ChaosHunter technical indicators applied to the price data exported from Trader and chooses functions for possible inclusion in the ChaosHunter model.

Step 4: Build a Trading System in ChaosHunter

As Easy as Pressing a Button!

Since the template takes care of the model building settings in ChaosHunter, our next step was to click on the train button in the ChaosHunter tool bar.

Step 5: Examine the ChaosHunter Model

We let ChaosHunter optimizer run overnight because the model kept improving.

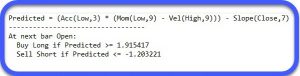

The result is the simple formula displayed below. The model used the Acceleration, Momentum, Velocity and Slope technical indicators included in ChaosHunter.

Step 6: Load ChaosHunter Model in Trader

We created a Trading Strategy in NeuroShell Trader based on the ChaosHunter model to compare it to our original Block Trades model. We used one of Trader’s External Program indicators designed for ChaosHunter to load the ChaosHunter model file (.md).

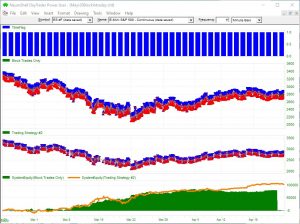

The green equity curve on the chart below shows the results for the BlockTrades only system. At the end of the optimization period, the net profit was $79,988 at 9 am on April 23, 2020. The ChaosHunter enhanced model returned $106,259 on that date (gold line). The positive results from the ChaosHunter model continued into the future.

https://nstsupport.wardsystemsgroup.com/support/files/May20newsletter.zip to download the example chart along with the ChaosHunter data and model files. You need to have the InterChart Tools TradeDate Add-on and ChaosHunter to open this example chart.